Advertisement

Updated February 2nd 2026, 14:59 IST

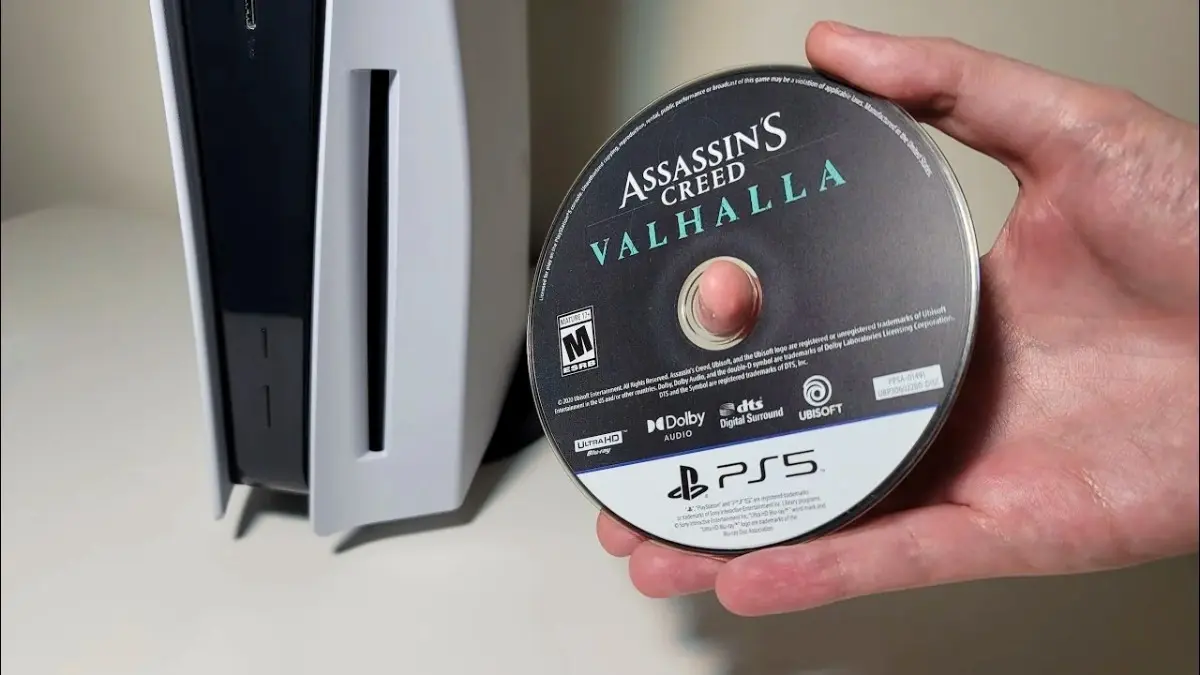

PlayStation, Xbox Gaming Discs May Cost More As Government Removes Import Exemptions

Budget documents and post-Budget tax notes indicate that the BCD exemptions earlier available on multiple goods were set to be withdrawn from April 1, 2026.

Physical gaming media imports could get more expensive in India after the Union Budget 2026-27 proposed withdrawing certain Basic Customs Duty (BCD) exemptions and concessional rates for imports of content recorded on physical media, an umbrella that includes motion pictures, music and gaming software. For buyers, that translates into a likely price impact on PlayStation and Xbox game discs (and other boxed physical media) brought into the country through import channels once the exemption window closes.

What changed in the Budget

Budget documents and post-Budget tax notes indicate that the BCD exemptions earlier available on multiple goods were set to be withdrawn from April 1, 2026. While the benefit has been extended for several goods, it has not been extended for imports of motion pictures, music and gaming software recorded on physical media, which means higher customs duty would apply to such imports made on or after April 1, 2026.

The same note also flags the withdrawal of BCD exemption or concessional rates for CD-ROMs containing educational books and other periodicals from February 2, 2026, signalling a broader tightening around duty relief for certain categories of recorded media.

Why physical discs may get pricier

When exemptions are removed, the landed cost rises because the applicable customs duty rate kicks back in. That higher landed cost typically works its way into MRPs over time, especially for imported physical media where duties, logistics, and distributor margins already form a sizeable portion of the final price.

Who will feel the impact?

Buyers who prefer boxed games over digital downloads could see fewer discounts and higher prices on new launches after April 1. Retailers and importers may adjust inventory planning, potentially pulling in stock ahead of the deadline or shifting mix toward faster-moving titles. However, digital downloads will not be impacted.

The bigger context: push for domestic value

The Budget’s indirect tax direction is framed around tariff rationalisation and encouraging domestic manufacturing in select categories. In gaming, however, physical discs are typically manufactured and mastered outside India, so the change functions less like a “local manufacturing boost” and more like a straightforward cost increase on imports.

Published February 2nd 2026, 14:59 IST